Smart + simple accounting

Powered by AI

With a dedicated team of experts, end to end AI Accountants tax solutions for

individuals + sole traders + small businesses.

Smarter AI Accounting. Powered by Accountants. Built for You.

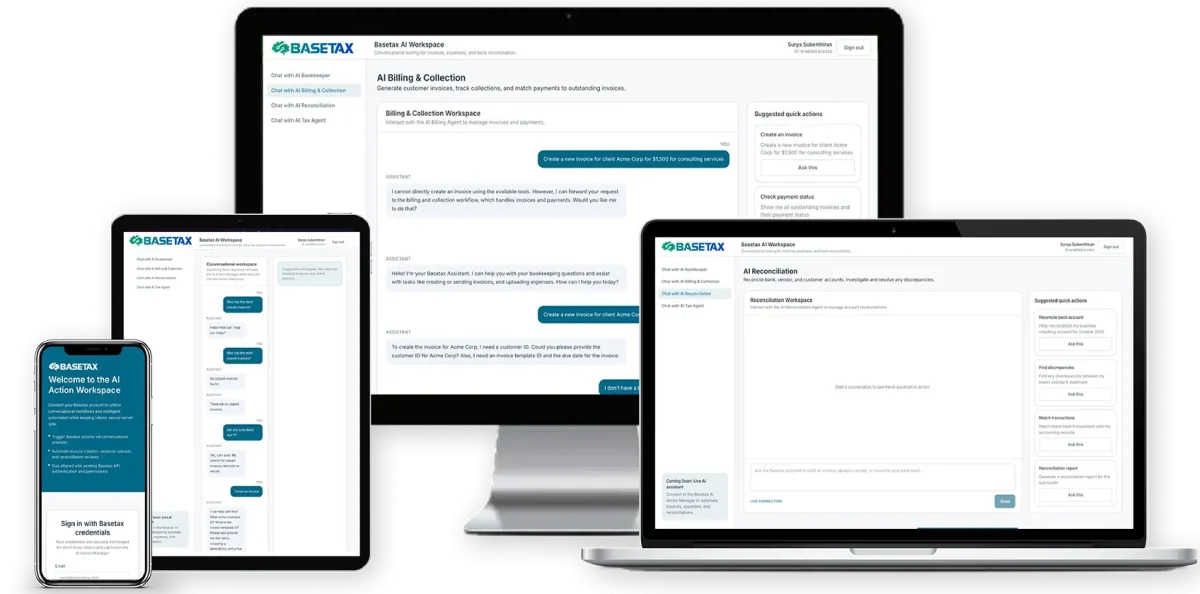

Introducing BaseTax.ai — our next‑generation accounting platform that automates bookkeeping, tax filing, and reporting. Spend less time on spreadsheets and more time growing your business. Whether you’re an accountant or a small business owner, our AI engine learns how you work and makes accounting effortless.

By submitting your email you agree to receive updates from BaseTax. You can unsubscribe at any time.

HMRC Recognised

File directly to HMRC Software

Tax Digital

Fully digital submission, no spreadsheets

Admin work

More than 70% of the admin work is automated, Categorising expenses, preparing drafts, chasing documents

Revenue model

Monthly bookkeeping, tax filing, and advisory — not one-off returns

Need software or an accountant to manage your tax?

Well, we have both - choose a plan that suits you

Bookkeeping software for sole trader and small businesses

File tax return directly to HMRC in minutes

Looking for a qualified

accountant to help you with your taxes or businesses?

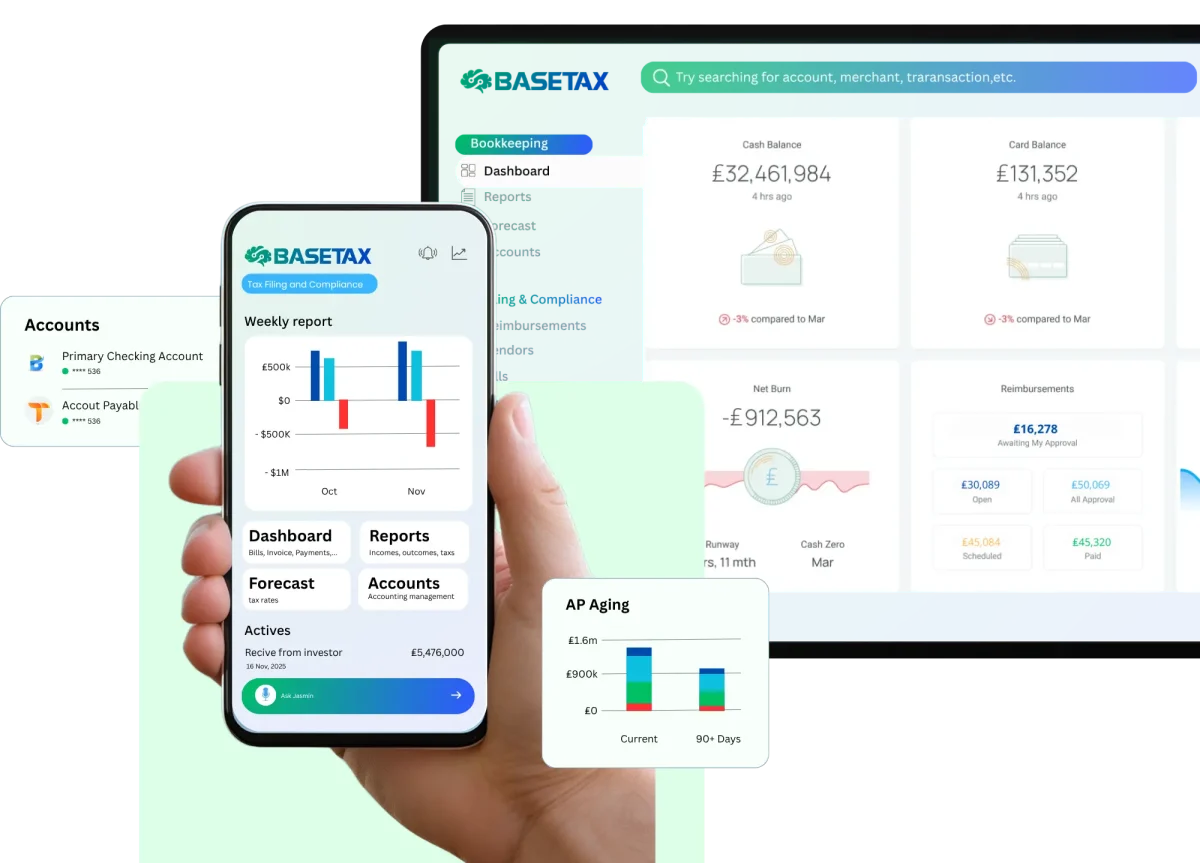

AI for Bookkeeping

Automate Your Bookkeeping Smartly

Automate your financial books accurately with Basetax

AI for Tax Filing and Compliance

Make Your Tax Filing Simple and Compliant

Streamline your tax submissions with full compliance with HMRC and MTD standards

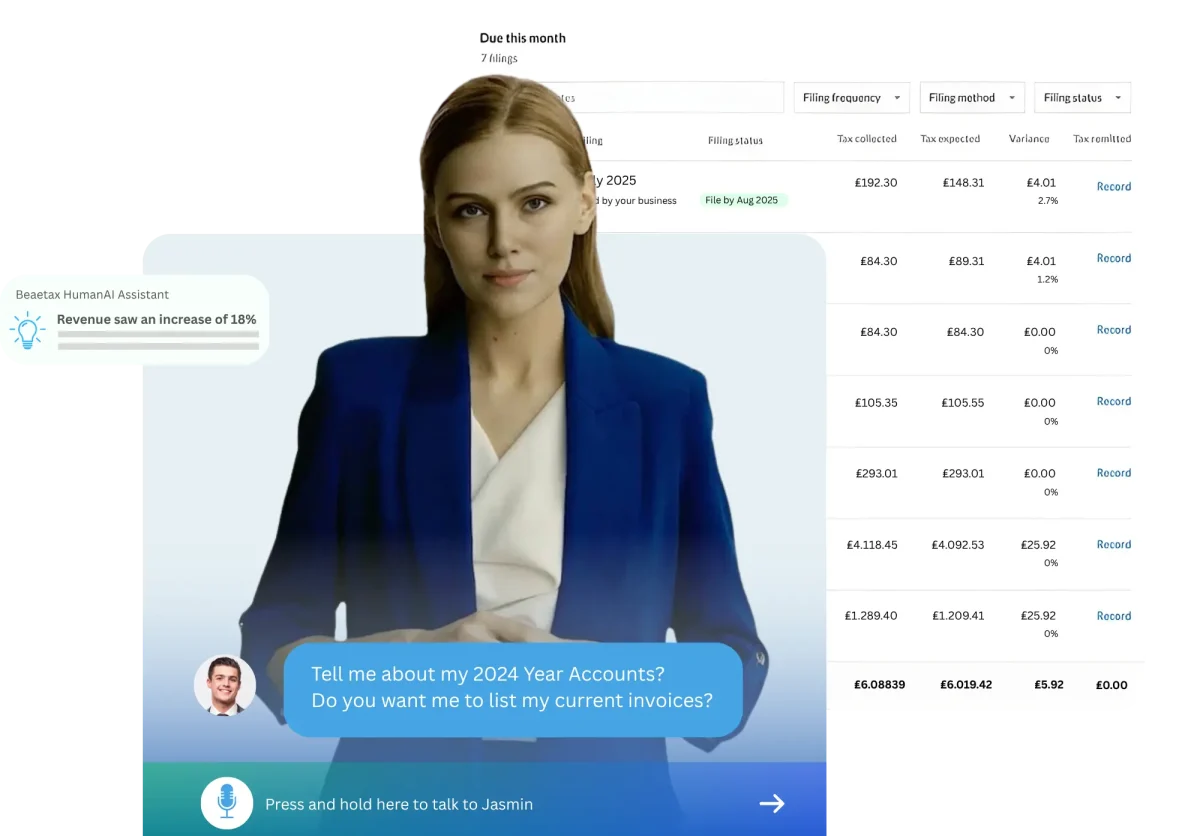

HumanAI Assistant

Enhance Your Business Accounting with HumanAI

Get Support To Manage Your Finances with HumanAI Assistant, powered by AI.DNA

AI-Powered Marketplace

Basetax Marketplace for Smarter Finance Choices

Get access to a network of lenders, credit scoring tools and financing options through partnerships with Basetax.ai’s marketplace, powered by Businessabc.net and ztudium’s AI.DNA

Our Pricing

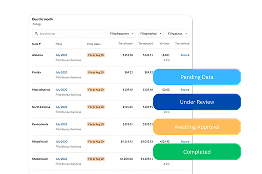

Let saves businesses on average 70 hours a month

Bookkeeping

Update your books daily, access real-time insights, and receive a dedicated finance team All on a single AI platform

Free

£ 0.00

Basic software for basic

bookkeeping

Limit to 50 transactions / month

Bookkeeping Club

£ 19.99/ month + VAT or £199/year + VAT

Basic software + Tax return for full

bookkeeping

Unlimited transactions

Bookkeeping Professional

£ 29.90/ month + VAT or £299/year + VAT

Full software + Accounting for Sole

Trader / Partnership

Unlimited transactions

*Pricing based on bookkeeping complexity, monthly expenses, and annual revenue

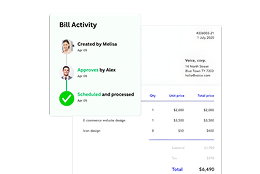

File Tax Return

Making Tax Digital (MTD) is HMRC’s system that requires you to keep digital records and submit your tax (like VAT and income tax) using approved software instead of paper or manual forms.

Tax return

£ 49.00 + VAT

- Includes one off per year - price GBP 49

- Timelines Waves for clients

- 2024 / 2025 - due by January 2026

- April 2026 - 2025/ 2026 Tax return due to January 2027

MTD

£ 9.99 / month — or £99 / year for savings

- Price for 4 quarter - GBP 99 - year or 9.99

- Quarterly + 1 final return - 5 times a year

- Bookkeeping MTD

- Sole trader

- Landlord

*Pricing based on bookkeeping complexity, monthly expenses, and annual revenue

Why Use Basetax?

Basetax has been helping sole traders, self employed and individuals with their accounting and tax since 2014.

We provide digital tax solution to make it easier for our users to file their tax returns.

Meet our team

With a dedicated team of experts, end to end AI tax solutions for individuals + sole traders + small businesses.

Join 500+ companies network managed annually by Basetax

Testimonials

What our clients

say about our

products

“Every once in a while I’m like oh my gosh I haven’t classified a transaction in months and it feels so good.If I hadn’t onboarded with Basetax, I would’ve been up all night building a balance sheet spreadsheet.”

Colin Lucido

I have been using Basetax for end of year accounts the past few years. Kah is a pleasure to work with, always delivers on time and offers great rates. Very professional and offers advice.

Jill Larmer

Resources and news

Inheritance Tax Efficiency Tips: How to Protect Family Wealth and Pass It on Wisely

Salary vs. Dividends: What’s the Best Way to Pay Yourself?

Annual Investment Allowance (AIA): A Guide to Unlocking Business Tax Benefits

How the Start-Up Loan Scheme is Empowering the Next Generation of Entrepreneurs

Why Managing Digital Receipts Matters for Tax Compliance

How to Find Your HMRC UTR Number for Self-Assessment

Become Basetax Affiliate

“Every once in a while I’m like oh my gosh I haven’t classified a transaction in months and it feels so good.If I hadn’t onboarded with Basetax, I would’ve been up all night building a balance sheet spreadsheet.”